The BBC today reported:

The government has incurred a loss of £2.1bn after selling another tranche of shares in Royal Bank of Scotland.

The shares were sold at 271p each, almost half the 502p a share paid in the government’s bailout of RBS a decade ago when it rescued the bank at the height of the financial crisis.

The return was “based on the reality of the situation that RBS is now in”, said Treasury Economic Secretary John Glen.

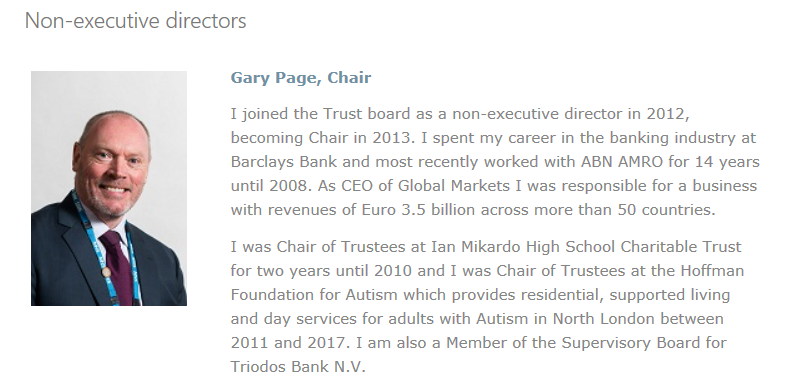

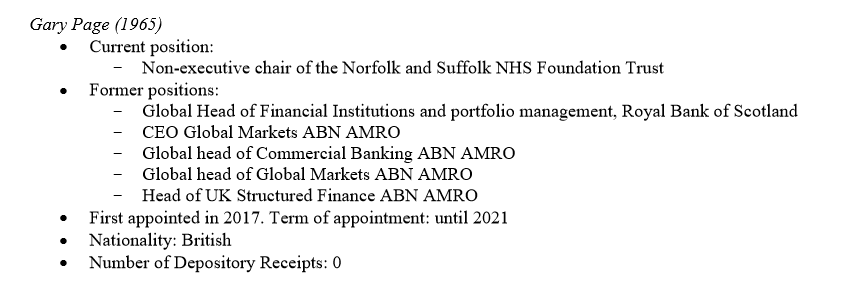

Where was Gary Page ten years ago?

Gary Page only lasted as Royal Bank of Scotland’s Global Head of Financial Institutions and Portfolio Management until November 2008 when according to press reports at the time, he lost his job, as the bankers’ hubris and irresponsibility became clear and the taxpayer was landed with an unbelievably enormous bill.

You wouldn’t know this from Gary Page’s profile at NSFT which lists his last former employer as ABN. We wonder why.

Financial regulators and institutions are rather less tolerant of being economical with the actualité than their NHS counterparts at NHS Improvement and the CCGs. In a Triodos Bank prospectus, where Gary Page is now a member of the Supervisory Board, it confirms Page’s last employment was at the top of RBS:

As the economy was driven to the brink and taxpayers had to spend billions rescuing the banks, the bankers got away with their bonuses and riches.

While those who rely on mental health services have paid the price of austerity, sometimes with their lives, and front line staff have been downbanded, subjected to pay freezes or made redundant, Gary Page has ignored repeated warnings, enforced mental health service cuts and enjoyed the proceeds of his banking ‘career’ in a glamorous stately pile in Suffolk with its fine furnishings and llamas.

Gary Page decided to rebuild his reputation and second career at Norfolk and Suffolk NHS Foundation Trust (NSFT).

We really wish he hadn’t.

The taxpayer and mental health services are, even today, still paying the price of bankers’ hubris and greed.

Imagine what a difference just today’s £2.1 billion would make to mental health services.

There was the money to rescue the banks but not to provide help to those in need.

Read the report on the BBC News website by clicking on the image below:

‘Rebuilt his reputation’……..as what.? Don’t forget this is a man who went on Look East and stated that the board had had no reports of any problems with the new Radical Redesign, even though the Union, carers, Service Users, and Staff had been warning the board for months about the impending disaster about to engulf the trust…..he is at best all three ‘wise monkey’s rolled into one…….and he’s definitely not paid peanuts.!!!!

Wow Thanks for this information i find it hard to come up with decent information and facts out there when it comes to this topic thank for the write-up website

Wow Thanks for this blog post i find it hard to stumble on awesome facts out there when it comes to this subject matter thank for the blog post website

link:Wow Thanks for this post i find it hard to track down beneficial knowledge out there when it comes to this topic thank for the site website

Wow Thanks for this write-up i find it hard to come across great advice out there when it comes to this topic appreciate for the site site

Wow Thanks for this posting i find it hard to acquire very good specifics out there when it comes to this topic appreciate for the write-up website

Wow Thanks for this piece of writing i find it hard to obtain good resources out there when it comes to this subject matter thank for the post site

Wow Thanks for this write-up i find it hard to identify decent information and facts out there when it comes to this material thank for the article site

best online pharmacies in mexico: mexican pharmacy – mexican pharmaceuticals online

best india pharmacy http://indiaph24.store/# ?»?legitimate online pharmacies india

reputable indian pharmacies

Wow Thanks for this publish i find it hard to uncover awesome important information out there when it comes to this content thank for the thread site

Wow Thanks for this post i find it hard to locate extremely good tips out there when it comes to this blog posts appreciate for the review site

Wow Thanks for this information i find it hard to obtain smart content out there when it comes to this subject matter thank for the write-up website

Wow Thanks for this write-up i find it hard to find awesome advice out there when it comes to this subject matter appreciate for the article site

world pharmacy india Cheapest online pharmacy ?»?legitimate online pharmacies india

best online pharmacies in mexico: mexican pharmacy – mexican rx online

https://indiaph24.store/# top online pharmacy india

top 10 pharmacies in india http://indiaph24.store/# best online pharmacy india

best online pharmacy india

mexican pharmaceuticals online Online Pharmacies in Mexico medicine in mexico pharmacies

tamoxifen and antidepressants femara vs tamoxifen tamoxifen therapy

https://nolvadex.life/# nolvadex d

buy cipro: ciprofloxacin generic – ciprofloxacin 500mg buy online

Wow Thanks for this post i find it hard to get a hold of great material out there when it comes to this subject matter thank for the publish site

Wow Thanks for this write-up i find it hard to get a hold of great answers out there when it comes to this topic thank for the guide site

nolvadex d nolvadex generic how to prevent hair loss while on tamoxifen

http://nolvadex.life/# does tamoxifen make you tired

http://lisinopril.network/# lisinopril 5 mg prices

cytotec abortion pill: buy cytotec in usa – purchase cytotec

nolvadex online tamoxifen estrogen nolvadex 10mg

https://cytotec.club/# cytotec pills buy online

benefits of tamoxifen does tamoxifen cause menopause low dose tamoxifen

where can i buy nolvadex: tamoxifen benefits – nolvadex 10mg

http://lisinopril.network/# cost of lisinopril 40mg

propecia without insurance get propecia without rx get cheap propecia pill

http://cytotec.club/# buy cytotec in usa

Cytotec 200mcg price: buy cytotec online – buy cytotec over the counter

buy cipro online ciprofloxacin over the counter purchase cipro

http://lisinopril.network/# compare zestril prices

lisinopril price without insurance: lisinopril 2.5 mg tablet – purchase lisinopril 40 mg

buying propecia pill propecia for sale cost of propecia prices

http://finasteride.store/# propecia generic

https://lisinopril.network/# zestril 20 mg price in india

tamoxifen and depression: tamoxifen 20 mg tablet – tamoxifen estrogen

cost propecia without a prescription order propecia pills buying generic propecia online

Personally, I enjoyed the photojournalism aspect of it, as it just as easily could have been another paint-by-numbers war film. It also shows a potential future where each side reaches their breaking point and conflict does ensue.

https://nolvadex.life/# tamoxifen bone density

ciprofloxacin 500 mg tablet price: antibiotics cipro – cipro for sale

https://lisinopril.network/# lisinopril capsule

http://finasteride.store/# generic propecia prices

nolvadex d tamoxifen hot flashes tamoxifen hip pain

buy cipro: cipro online no prescription in the usa – antibiotics cipro

http://cytotec.club/# purchase cytotec

lisinopril 20 mg canadian: lisinopril 250 mg – prinivil tabs

?»?cipro generic cipro pharmacy buy cipro online canada

https://ciprofloxacin.tech/# buy cipro online without prescription

purchase cipro: buy cipro online canada – buy cipro cheap

https://lisinopril.network/# medication lisinopril 20 mg

buy misoprostol over the counter cytotec online cytotec online

https://nolvadex.life/# tamoxifen 20 mg

Vardenafil buy online Cheap Levitra online Levitra 10 mg best price

https://cenforce.pro/# Buy Cenforce 100mg Online

https://viagras.online/# buy viagra here

http://cenforce.pro/# cenforce for sale

viagra without prescription Buy Viagra online sildenafil 50 mg price

http://cenforce.pro/# Cenforce 150 mg online

Cenforce 100mg tablets for sale: cenforce.pro – Buy Cenforce 100mg Online

Buy Tadalafil 10mg buy cialis overseas cheapest cialis

Viagra online price Cheapest place to buy Viagra Cheapest Sildenafil online

https://viagras.online/# Viagra generic over the counter

http://kamagra.win/# Kamagra tablets

Cenforce 150 mg online Cenforce 100mg tablets for sale cenforce.pro

Cialis without a doctor prescription: buy cialis online – Cialis over the counter

super kamagra kamagra pills buy kamagra online usa

https://cenforce.pro/# Cenforce 100mg tablets for sale

Wow Thanks for this posting i find it hard to unearth really good related information out there when it comes to this subject matter thank for the blog post site

Buy Tadalafil 20mg cialist.pro Tadalafil Tablet

Wow Thanks for this publish i find it hard to get really good material out there when it comes to this material appreciate for the review site

http://cialist.pro/# Cialis over the counter